Anti-Money Laundering Measures

1 Significance of AML/CFT measures

Money laundering refers to attempts to evade the discovery of money obtained through illicit means, especially criminal proceeds, and arrests, etc. by investigative authorities, etc. by concealing the sources or beneficial owners of the money. If effective measures are not taken against money laundering, criminal proceeds will continue to be utilized for further crimes or be used to promote organized crimes. Money laundering utilized by transferring could also pose a serious threat to sound economic activities. Therefore, in order to ensure the safety and peace of national life and the sound development of economic activities, it is critical to take positive steps for AML/CFT.

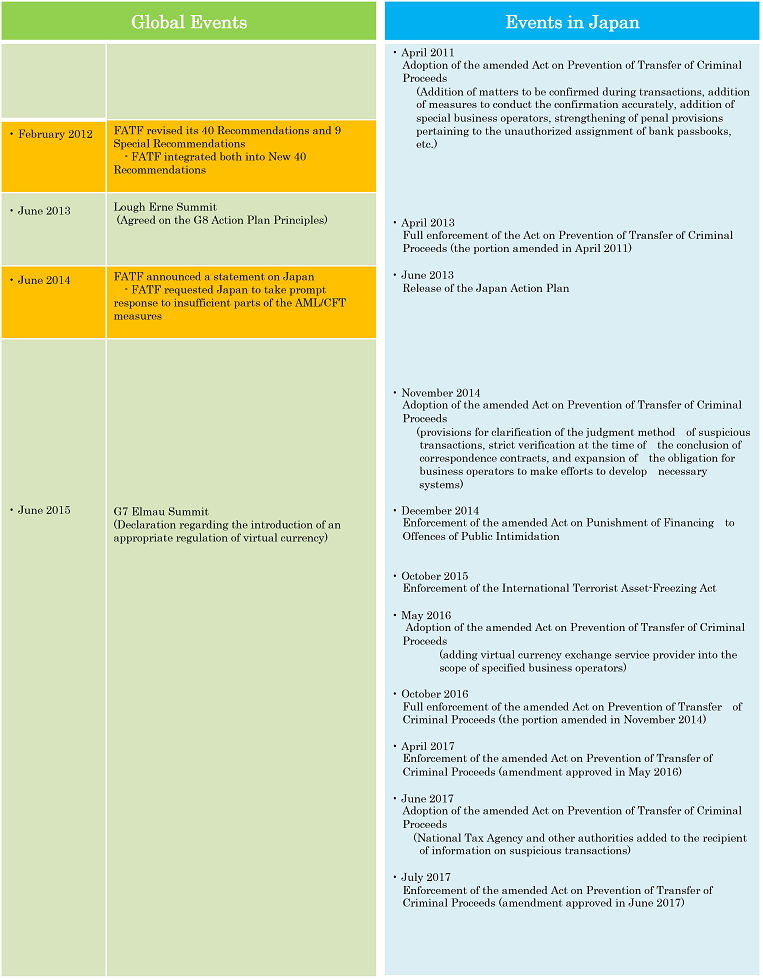

The international community has continued to develop AML/CFT regimes in an effort to prevent and eradicate money laundering and terrorist financing (ML/TF) as mentioned below. Accordingly, Japan has also been working on the Anti-Money Laundering and Countering the Financing of Terrorism regimes (hereinafter referred to as "the AML/CFT measures, etc.") in cooperation with the international community.

We consider that the various AML/CFT regimes, etc. put in place and the follow-up activities we have made for their effective implementation, as described in this report, illustrate our dedication to taking on the global challenge of combating ML/TF and implementing robust domestic efforts.

2 AML/CFT Regime in International Society

-

(1) Anti-Money Laundering as a Countermeasure against Narcotic Drugs

Through the 1980s, the global spread of narcotics abuse was considered to be a crisis in the international community, prompting a variety of initiatives to address this issue. Especially in fighting against illegal transactions by transnational drug-trafficking organizations, it was recognized as important to take all possible measures to inflict damage on the sources of their funds, such as confiscating illegal proceeds from drug manufacturing and trafficking and effectively preventing their money laundering activities. In this context, the UN New Narcotics Convention was adopted in December 1988, and it required each state to criminalize activities such as hiding drug crime proceeds and to establish relevant regulations to confiscate such proceeds. At the Arch Summit in July 1989, in order to deepen international cooperation on money laundering initiatives related to drug crimes, the major developed countries took the initiative to establish the FATF. In April 1990, urged by the need for standardizing measures in different countries, the FATF devised “The 40 Recommendations” as standards for anti-money laundering measures to be applied in the fields of law enforcement, criminal justice, and the financial system. “The 40 Recommendations” required early ratification of “the UN New Narcotics Convention,” the development of domestic laws prescribing anti-money laundering measures, and the establishment of measures, such as obligations to conduct customer identification and to report suspicious transactions by financial institutions. -

(2) Anti-Money Laundering as a Countermeasure against Organized Crime

In the 1990s, the international expansion of organized crime was recognized as a phenomenon that could threaten each country’s security, and therefore the United Nations took the initiative to establish an international convention against international organized crimes. At the Halifax Summit in June 1995, it was pointed out that effective measures to prevent the concealing of proceeds not only from drug-trafficking but also from any other serious crimes were also necessary for successful countermeasures against transnational organized crimes. In accordance with these movements, in June 1996, the FATF revised a part of “The 40 Recommendations,” and recommended that, in addition to drug crimes, the scope of predicate offences for money laundering measures be extended to include other serious crimes. Further, at the Birmingham Summit in May 1998, the participating countries agreed to create an FIU (Financial Intelligence Unit) in each country, which is dedicated to collecting, arranging, and analyzing money laundering information, and to disseminating the information to investigative authorities.The Egmont Group, established in 1995 as a forum for exchanging information between FIUs, defines an FIU as a “central, national agency responsible for receiving and analyzing information reported by financial institutions and providing such information to the competent authorities to support the government’s anti-money laundering measures; it shows a way for exchanging information that is important for law enforcement agencies.” -

(3) Countermeasures against Terrorist Financing

In countering the financing of terrorism, anti-money laundering measures were thought in most part equally applicable to it, given that among other matters, in terms of prevention it is critical to intercept the terrorist financing, clarify the sources of the funds, and promote international cooperation. Based on the concepts noted above, the International Convention for the Suppression of the Financing of Terrorism, adopted in December 1999, requires that the signatory countries have mechanisms in place to criminalize terrorist financing and the collection of funds for terrorism, to confiscate terrorist finances, to verify customer identity by financial institutions, and to report on suspicious transactions. Subsequently, in response to the terrorist attacks on the U.S. in September 2001, the FATF held an emergency session in October of the same year, when it issued “The 8 Special Recommendations,” at which time it included measures to counter terrorist financing as part of its mission, as well as criminalizing terrorist financing and freezing terrorist assets as an international standard for fighting terrorist financing.In October 2004, a new recommendation related to the measures to prevent the physical cross-border transportation of funds was added to these recommendations, which made them “The 9 Special Recommendations.” -

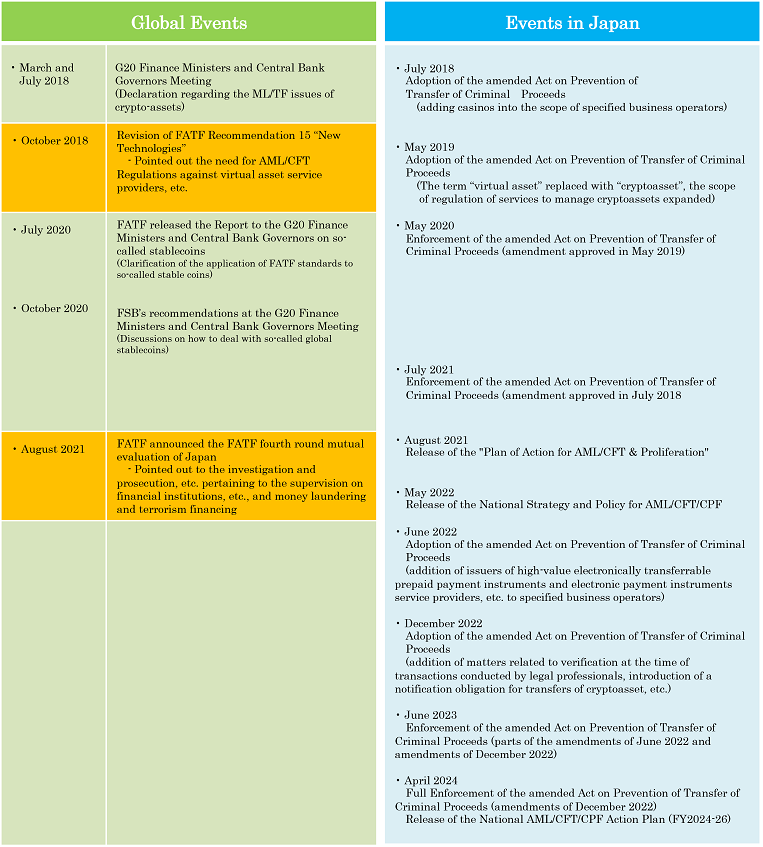

(4) Countermeasures against Changing ML/TF Trends

With the development of AML/CFT measures, the trends of ML/TF have also been changing, such as the employment of new tactics, including the use of businesses other than financial institutions to conceal criminal funds. As a result, in June 2003 the FATF revised “The 40 Recommendations,” extending the scope of operators required to implement the Recommendations to designated non-financial businesses and professions (DNFBPs). Furthermore, in February 2012, the 40 Recommendations and 9 Special Recommendations were integrated and upgraded to become the new 40 Recommendations in order to properly address the proliferation of weapons of mass destruction, as well as the additional threat of corruption, including the bribery of public officials and the appropriation of property. At the Lough Erne Summit in June 2013, the participating countries agreed on the G8 Action Plan Principles, in response to today’s situation surrounding CFT measures and the fact that legal persons with nontransparent ownership and management structures and legal arrangements are misused for money laundering and tax evasion. The G7 Leaders’ Declaration issued in the G7 Summit at Schloss Elmau in June 2015 pointed to the risks that virtual currencies could be misused for terrorist financing and concealment of terrorist funds, and stated that the members will take further actions to ensure greater transparency of all financial flows, including through the appropriate regulation of virtual currencies and other new payment methods. The FATF Guidance issued in June 2015 also stated that exchangers of fiat currencies and virtual currencies should be licensed or registered and regulated by AML/CFT laws, along with the customer due diligence (CDD), STR, recordkeeping, and other obligations. Moreover, the Communiqué of the G20 Finance Ministers and Central Bank Governors Meeting in March and July 2018 noted that crypto-assets raise ML/TF issues. Following this statement, in October 2018 the FATF revised its Recommendations to include the need for AML/CFT regulations on virtual asset service providers, wallet providers, and providers of ICO (initial coin offering)-related financial services.

(Note) The term "virtual currency" used at the G7 Summit at Schloss Elmau, etc. was translated the "kasou tsuuka (virtual currency)" in Japanese, but later in international discussions, such as the meeting of G20 Finance Ministers and Central Bank Governors, "crypto-asset" has been used instead of "virtual currency," and " virtual asset" has been translated as "angou shisan (cryptoassets)" in Japanese.

3 AML/CFT Regime in Japan

-

(1) Enforcement of “the Anti-Drug Special Provisions Act”

Anti-money laundering measures in Japan have been developed in accordance with the increasing awareness of AML/CFT among the international community. Firstly, in June 1990, the then Director-General of the Banking Bureau at the Ministry of Finance issued a notice that demanded that financial institutions verify customers’ identities. Next, “the Anti-Drug Special Provisions Act” was enforced in July 1992 as one of the domestic laws implementing the “New Narcotics Convention,” aiming mainly at dealing with drug crime proceeds. This law criminalized money laundering activities related to drug crime proceeds for the first time in Japan and established the suspicious transaction reporting system (regarding drug crime proceeds) by financial institutions etc., in response to “The 40 Recommendations.” -

(2) Enforcement of “the Act on Punishment of Organized Crimes”

The FATF first round mutual evaluation of Japan in 1994 recommended remedial actions to be taken for the limited scope of predicate offences for money laundering that had targeted only drug crimes. As a practical matter, it was extremely difficult for reporting entities to determine if each transaction was actually related to drug crimes in reporting suspicious transactions, resulting in fewer suspicious transaction reports. This ineffectiveness was partially caused by the fact that there was no system in place to collect reported information or to disseminate it to the investigative authorities.To address these problems, “the Act on Punishment of Organized Crimes” was enforced in February 2000 in Japan based on “The 40 Recommendations,” as revised in 1996. This law represented progress for the regulations against criminal proceeds on several points. Firstly, the scope of predicate offences for money laundering was extended to include other serious crimes in addition to drug-related crimes. Secondly, the scope of crimes subject to the suspicious transaction reports regime was also extended to include other serious crimes besides drug crimes. Thirdly, the law mandated that the Financial Supervisory Agency (later reorganized to the Financial Services Agency) serve as the FIU of Japan, and the Japan Financial Intelligence Office (JAFIO) was established within the agency, accordingly. -

(3) Enforcement of “the Act on Punishment of Terrorist Financing” and “the Act on Customer Identification by Financial Institutions,” and Amendment of “the Act on Punishment of Organized Crimes”

As a major development after the terrorist attacks in the U.S., “the Act on the Punishment of Financing to Offences of Public Intimidation” was enforced in July 2002 as a domestic law to join “the International Convention for the Suppression of the Financing of Terrorism,” criminalizing terrorist financing and the collection of funds for terrorism.At the same time, “the Act on Punishment of Organized Crimes” was partially amended, so that the terrorist financing offences were prescribed as a predicate offence. Moreover, terrorist funds were prescribed as criminal proceeds. Consequently, the property suspected to be a terrorist fund becomes subject to reporting as a suspicious transaction.Also, to implement the obligations of customer identification and record keeping required under the said Convention and the 40 Recommendations, “the Act on Confirmation of Customers Identification by Financial Institution, etc." was enforced in January 2003.Due to the frequent misuse of deposit accounts in another person’s name or fictitious names for crimes like billing fraud, the Act was amended in December 2004 to prohibit a person with punishment to receive from or give to another person a passbook, etc., and to solicit another person or induce another person to commit an act, and the Act was renamed as "the Act on Confirmation of Customers Identification by Financial Institution, etc. and Prevention of Unauthorized Use of Deposit Account, etc."(hereinafter referred to as "the Customer Identification Act"). -

(4) Development of “the Act on Prevention of Transfer of Criminal Proceeds”

In response to the extension of the scope of businesses subject to customer due diligence (CDD) and other obligations to include DNFBPs in 2003, in December 2004, “the Headquarters for Promotion of Measures Against Transnational Organized Crime and International Terrorism,” with the Chief Cabinet Secretary as its head, published “the Action Plan for Prevention of Terrorism,” including consideration of the implementation of the re-revised 40 Recommendations. In November 2005, the abovementioned Headquarters decided that [i] the National Public Safety Commission and the National Police Agency would draft a bill to implement the re-revised Recommendations, [ii] the FIU function would be transferred from the Financial Services Agency to the National Public Safety Commission and the National Police Agency, and [iii] the competent authorities would provide STR-related guidance and supervision to relevant business sectors.The National Police Agency drafted the bill, in cooperation with the relevant ministries and agencies, quoting the Customer Identification Act and a portion of the Act on Punishment of Organized Crimes, and submitted it to the 166th National Diet session in February 2007. “The Act on Prevention of Transfer of Criminal Proceeds” was then adopted in March of that year. The partial enforcement of the Act prescribing the transfer of the FIU function was carried out in April of the same year, while the expansion of specified business operators subject to the CDD obligation and other remaining provisions were enforced in March 2008. As a result, the Customer Identification Act was repealed.In April 2011, in consideration of the discussions on recommendations made under the FATF Third Round Mutual Evaluation of Japan in 2008, and in light of damages caused by billing fraud in Japan, the following amendments were made to the Act on Prevention of Transfer of Criminal Proceeds; additional points to verify on transactions of specified business operators, addition of telephone forwarding service providers to the list of specified business operator, addition of measures for accurate verification at the time of transactions, and strengthening punishments on illicit transfer of passbooks, etc. The amended Act was fully enforced in April 2013.Following the G8 Action Plan Principles agreed at the G8 Lough Erne Summit in 2013, Japan also expressed its strong commitment to it by announcing the Japan Action Plan in June 2013, according to which necessary actions, including the national risk assessment of ML/TF, should be undertaken.In November 2014, based on the aforementioned results in the FATF Third Round Mutual Evaluation of Japan, the government partially amended the Act on the Punishment of Financing to Offences of Public Intimidation (which came into force in December 2014) and established the International Terrorist Asset-Freezing Act (now referred to as the International Terrorist, etc. Asset-Freezing Act) (October 2015). The Act on Prevention of Transfer of Criminal Proceeds was also partially amended to [1] add provisions regarding the responsibilities of the National Public Safety Commission in relation to the preparation of national risk assessment follow-up reports (NRAs), [2] clarify the criteria for suspicious transactions, [3] ensure stricter verification of correspondence contracts, [4] and expand the obligation for business operators to make efforts to develop the necessary frameworks (which came into force in October 2016).In response to the G7 Leaders’ Declaration in the Elmau Summit in 2015 and the FATF Guidance, Japan amended the Payment Services Act in May 2016 to regulate and license virtual currency exchange service providers. Japan also established the Act Partially Amending the Banking Act, etc. for Responding to the Advancement of Information and Communications Technology and Other Environmental Changes, which partially amended the Act on Prevention of Transfer of Criminal Proceeds to include virtual currency exchange service providers in the scope of specified business operators. This Act came into force in April 2017.In May 2019, with the partial amendment of the Payment Services Act, the term "virtual currency" prescribed in the Payment Services Act was changed to "cryptoasset," and necessary amendments were carried out for the Act on Prevention of Transfer of Criminal Proceeds, such as changing the term "virtual currency exchangers" to " cryptoasset exchange service providers" (enforced in May 2020).In June 2017, in response to the expansion of the scope of predicate offences related to criminal proceeds through the partial amendment of the Act on Punishment of Organized Crimes, the Act on Prevention of Transfer of Criminal Proceeds was partially amended to expand the scope of receivers of STRs to include the officials of the National Tax Agency and other authorities, who are in charge of investigations of tax offences relating to offences that fall under the expanded scope of predicate offences. This Act came into force in July 2017. In response to the FATF Recommendations, which pointed out the risks that casinos may be used for ML/TF purposes and the need to introduce CDD obligations for customers engaging in financial transactions exceeding a certain threshold, Japan established the Act on Development of Specified Integrated Resort Districts in July 2018, which partially amended the Act on Prevention of Transfer of Criminal Proceeds to include casino business operators in the scope of specified business operators. This Act came into force in July 2021.In June 2022, based on the discussions on how to deal with so-called global stablecoins at the G20 Finance Ministers and Central Bank Governors Meeting, the Financial Stability Board (FSB), the FATF, etc., and also the moves to consider regulations in foreign countries, Japan partially amended the Payment Services Act to introduce business regulations, such as a registration system for electronic payment instruments service providers. Japan also partially amended the Act on Prevention of Transfer of Criminal Proceeds and enacted the Act to Partially Amend the Payment Services Act and Other Related Acts to Establish a Stable and Efficient Payment Services System, including the addition of electronic payment instruments service providers to specified business operators This Act came into force in June 2023.In the FATF Fourth Round Mutual Evaluation Report (MER) of Japan published in August 2021, it was recommended that Japan work on strengthening countermeasures against virtual assets and amending laws to strengthen the AML measures. In light of this, in December 2022, the “Act to Partially Amend the Act on Special Measures Concerning the Asset-Freezing of International Terrorists Conducted by Japan Based on United Nations Security Council Resolution 1267, etc., to Deal with International Transfers of Unlawful Funds” (hereinafter referred to as the “Act to Respond to FATF Recommendations”) was enacted.The Act to Respond to FATF Recommendations is an amended Act that collectively performs a total of six amendments of laws and acts, including the Act on Prevention of Transfer of Criminal Proceeds, the Act on Punishment of Organized Crimes, and the Anti-Drug Special Provisions Act. It also covers amendments to the Act on Punishment of Organized Crimes and the Anti-Drug Special Provisions Act that are intended to raise statutory penalties for the crime of money laundering, amendments to the Act on Punishment of Organized Crimes to expand the scope of property that can be confiscated as criminal proceeds, and amendments to the Act on Punishment of Terrorist Financing to expand the constituent requirements of punishment provisions and to raise statutory penalties. The Act on Prevention of Transfer of Criminal Proceeds was amended to impose on cryptoasset exchange service providers as specified business operators the obligation to notify regarding the transfer of cryptoasset (enforced in June 2023), to include matters related to verification at the time of transactions conducted by legal professionals as specified business operators, and to establish the provisions for the STR reporting obligation (enforced in April 2024).The major amendments to laws that have recently been made are discussed in Chapter 2 (Legislative Regime on AML, etc.).The National Police Agency, together with other relevant government ministries and agencies, has amended laws and regulations related to the AML measures, etc. as appropriate, including the Act on Prevention of Transfer of Criminal Proceeds, thereby responding to changes to social conditions and addressing the deficiencies identified in the FATF (MER) of Japan.

4 History of Anti-Money Laundering Measures